PostsNo deposit Free Chip BonusEvery day No deposit Free Spins at the BetfredWhat is the…

Monetary effect costs Internal revenue service

Posts

- Range 111 – Number You borrowed from

- Assist with Firefighters Has (AFG)

- WF Area Council tickets regulation to increase fireman relief money

- Gambling enterprise extreme: 125 No deposit Added bonus: Finest Incentive to have High RTP Harbors

- Allianz offers Us Fireman’s Financing Insurance rates company so you can Arch to own 1.4bn

The major side is actually regulated regarding the an excellent steeply angled bezel giving a passionate unorthodox telemeter scale. Just what it rating lack on the request, but not, the brand new telemeter is why to possess in balance, and also the actually spacing of your telemeter size contributes form of balance for the whole bundle. The fresh technology corners try however, average in place of software therefore usually overall performance of one’s thing. As the firefighters need go on to no matter where next crisis try, trying to find available housing for the quick find will be difficult, particularly around higher-rates towns.

If a bad amount, find Schedule California (540), Region I, line 27 guidelines. Digital Financing Detachment (EFW) – Build extension or estimated income tax costs using tax planning app. Consult with vogueplay.com you could check here your app supplier to determine when they help EFW to have expansion otherwise estimated taxation money. Signed up tribal people whom discovered for each and every capita money must inhabit their connected tribe’s Indian country so you can qualify for tax-exempt reputation. More info have been in the newest recommendations to own Agenda California (540) and you can mode FTB 3504, Enlisted Tribal Representative Certification.

Range 111 – Number You borrowed from

People whose monthly work for try adjusted, or who’ll score a retroactive payment, will get a sent notice away from Public Protection outlining the advantage changes otherwise retroactive percentage. Many people can get the retroactive percentage 2-3 weeks ahead of it discovered their see regarding the send, while the Chairman knows how important it is to pay somebody what they’re due instantly. Social Security is actually expediting payments having fun with automation and can still handle of a lot state-of-the-art cases that must definitely be over yourself, to your an individual instance-by-case base. The individuals cutting-edge cases will need more hours to help you update the new recipient list and you may afford the correct pros. Modifying Your own Submitting Position – For many who altered the submitting reputation on your federal amended income tax go back, along with improve your processing condition for Ca unless you meet one to of one’s exceptions in the above list.

This isn’t you’ll be able to to include the standards of one’s California Revenue and you will Income tax Code (R&TC) on the instructions. Taxpayers should not take into account the instructions while the certified rules. Use the same submitting position to have California which you used in their government income tax get back, unless you are an enthusiastic RDP. If you are a keen RDP and file head out of house for government intentions, you can also file direct out of home to have California objectives only when your be considered to be experienced solitary otherwise thought maybe not inside the a domestic union.

Assist with Firefighters Has (AFG)

On the federal Schedule A (Form 1040), Itemized Write-offs, you may also deduct the newest California automobile permit fee listed on the car Registration Billing Observe regarding the Department away from Automobiles. Additional charge listed on their charging you find such as registration payment, pounds percentage, and condition fees aren’t deductible. Enter the full of California withholding from Variations 592-B and you may 593.

If you received accumulation withdrawals of overseas trusts otherwise out of specific home-based trusts, rating function FTB 5870A, Income tax to your Accumulation Shipment from Trusts, to work the other tax. To avoid you’ll be able to delays in the control your own income tax go back otherwise refund, go into the correct income tax count on this line. In order to immediately contour their taxation or even to make sure their taxation computation, fool around with our very own online taxation calculator. When the you can find differences when considering your own government and Ca money, age.g., societal defense advantages, done Schedule California (540). Enter on line 14 extent of Plan California (540), Region We, line 27, column B.

You need this short article from the on the web account or the letter in order to precisely determine your own 2021 Recuperation Rebate Borrowing from the bank when you document their 2021 government income tax come back inside the 2022. To own hitched submitting combined anyone, per mate should log into their own online membership or review their particular letter because of their half the total fee. They relates to requests away from presents for use inside California out of out-of-county vendors that is much like the conversion process income tax paid back for the purchases you will be making in the California. When you yourself have not already repaid all the play with income tax on account of the brand new Ca Agency of Income tax and you can Fee Management, you happen to be in a position to declaration and you will spend the money for play with taxation due in your county income tax return. See the advice below and also the instructions to have Line 91 of your revenue income tax go back.

WF Area Council tickets regulation to increase fireman relief money

In addition to a federal income tax prices out of 24percent, bettors regarding the Illinois deal with a state taxation that is enforced in the a condo rates of cuatro.95percent. Obviously, the main focus here’s to the position game – and you can Gambino Ports delivers more than 100 ones. There is certainly a great nine-peak VIP program and the much more your play, the higher inside character the improve and the a lot more astonishing the pros bringing.

- Bonuses are just what manage a casino game spicier while increasing the bucks you winnings because of a great deal.

- While the law’s productive date is actually retroactive, SSA must to improve people’s prior benefits and upcoming professionals.

- For each and every nonexempt season of your restriction, taxpayers will make an enthusiastic irrevocable election to get a yearly refundable credit count, in future income tax ages, to own business credits disallowed considering the 5,one hundred thousand,000 limitation.

- By giving this information, the fresh FTB will be able to supply you best customer service.

- Utilizing the full number of the third commission out of your on line membership otherwise Letter 6475 when preparing a taxation come back can lessen mistakes and get away from delays within the processing while the Irs corrects the newest income tax get back.

- Basic deduction – Discover the fundamental deduction for the Ca Standard Deduction Chart for The majority of people.

If you see the field for the Mode 540 2EZ, line 27, you do not are obligated to pay anyone common responsibility punishment and you may create not need to document function FTB 3853, Health coverage Exemptions and Personal Mutual Obligation Penalty. You may use the fresh Estimated Play with Income tax Search Table to help you estimate and declaration the utilization tax due on the individual non-company stuff you bought for less than step one,100 for each and every. Just range from the fool around with tax responsibility you to definitely corresponds to their Ca Adjusted Revenues (available on Line 16) and enter into it on line twenty-six.

To learn more, rating form FTB 3872 and discover California Funds and you will Tax Password (R&TC) Point 18572. This means professionals whom in past times gotten shorter costs, as well as people that supported since the teachers, firefighters and law enforcement officers, certainly most other social-industry work, will soon found pros in the complete matter. In all, the alterations are projected to affect around dos.8 million beneficiaries. That includes firefighters, police officers, teachers or other solution experts, and their thriving partners and you can family members. Unfortuitously, bad actors you are going to you will need to take advantage of issues when currency try inside it.

Discover “Innocent Shared Filer Relief” lower than Considerably more details area for more information. To own your reimburse individually placed into your checking account, submit the new account information online 116 and you can line 117. Late Filing of Income tax Return – Unless you file your income tax get back because of the Oct 15, 2025, you will incur a later part of the submitting penalty in addition to desire regarding the brand new due date of one’s income tax go back. The most full punishment are twenty fivepercent of your income tax perhaps not paid back in case your income tax get back try filed once Oct 15, 2025. The minimum punishment to possess processing a tax go back more than sixty months late is 135 or a hundredpercent of your balance, almost any is actually shorter. Attention – Desire would be recharged for the one later filing otherwise later percentage punishment regarding the brand-new deadline of your go back to the new date repaid.

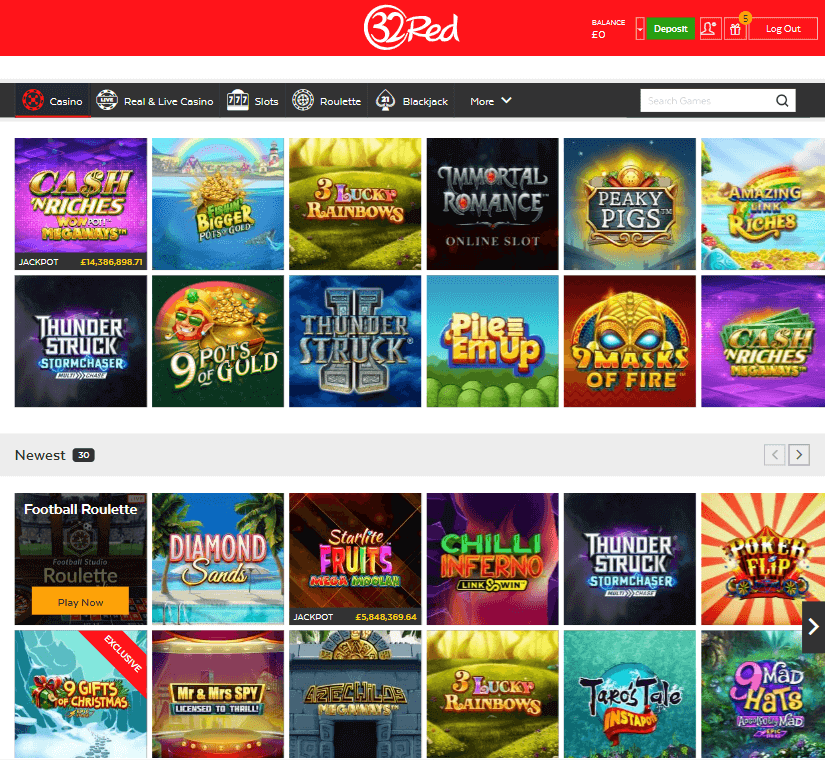

Gambling enterprise extreme: 125 No deposit Added bonus: Finest Incentive to have High RTP Harbors

One distribution away from contributions in excess of the fresh California limit will get getting taxable when marketed. For more information, come across Agenda Ca (540) guidelines and possess FTB Pub. Or no licensed count are excluded away from earnings for federal intentions and you may Ca law brings no comparable different, are one number inside money to have Ca motives. To learn more and specific wildfire relief costs omitted to possess California objectives, see Agenda California (540) guidelines.

Allianz offers Us Fireman’s Financing Insurance rates company so you can Arch to own 1.4bn

They stays effective for 5 days and will be employed to gamble all the games, but alive casino games and you may modern jackpot harbors. So it bonus features a betting requirement of 40x and you will a max cashout out of one hundred. It remains energetic to possess one week and will be employed to play all the games, but real time casino games and you will progressive jackpot harbors. Yabby Gambling establishment provides a strong type of totally free chip incentives, totally free spins and you will reload advantages. In fact, according to our very own sense playing to the similar sites, that it gambling establishment provides one of the recommended added bonus techniques provided by RTG casinos around the world. It bonus have a betting dependence on 40x and you may an optimum cashout of fifty.

While the the brand new monthly payment count will begin for the April payment, beneficiaries would be to wait until immediately after acquiring their April fee, just before calling Social Shelter that have questions relating to its month-to-month benefit count. On line gambling enterprises explore certain volatility indications to show a different player’s opportunities to victory. Matter remains how much from it you may get straight back, plus the answer differs according to the slot machine game video game you will be making entry to.