To stay focused on their primary role in healthcare, medical professionals must ensure their tax…

Payroll Software for Small Businesses

Customizing the dashboard and viewing employee benefits was easy, while payroll and onboarding posed some challenges. I discuss my specific obstacles with payroll in the next section. 1There are additional requirements for the basic records that an employer must maintain under various federal and state laws.

What Is the Difference Between Paychex and Paychex Flex?

When all deductions are subtracted from the gross wages, the result is the employee’s net or take home pay. We will help you transfer any existing payroll information to QuickBooks.

Then, it prepares and delivers W-2 forms to your employees when needed. Finally, for employees, it will manage your unemployment taxes and claims on your behalf. Gusto offers three plans for companies looking to manage payroll for both full-time employees and contractors. Paychex Flex Select provides expert service to match your business needs to our solutions. Process payroll, file taxes online, and have access to online employee training and development with 24/7 support.

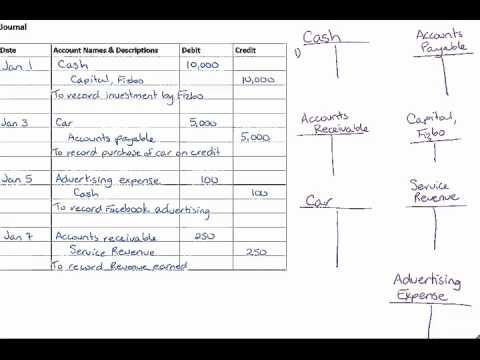

From this screen, I was also given the option to import time tracking data from ADP’s time and attendance add-on or another time keeping software. When I clicked “next,” I accessed an overview of payroll as it currently stood, including who would be paid, when, and how much they’d be paid broken down into gross pay, taxes, deductions, net pay and employer taxes. RUN by ADP offers advanced features for automated payroll processing, tax payments and filing and time tracking. Considering the time and cost savings a payroll management system can deliver, now is a great time to find a provider that can work closely closing entry definition with your business. Explore our payroll processing solutions built to help businesses of all sizes meet their needs.

- It strips away the complex features of the broader Paychex platform to stand out as a provider of easy employee payroll.

- Wave Payroll earns four out of five stars on Capterra with 61 reviews and 4.1 out of five stars on G2 with 31 user ratings.

- Process payroll, file taxes online, and have access to online employee training and development.

- In my experience, setting up automations was as intuitive as possible, given the large ripple effect each automation produces.

- Employers—or your accountant, bookkeeper or HR employee—set up benefits and salaries for employees and, on some platforms, contractors.

Paychex Flex

The initial dashboard offers key summary information and links, such as time-off and sick-day calculations, paycheck stub links, a task list and a time tracker. PEOs like Justworks are a good fit for types of liquidity ratios small businesses with complex hiring and potential business liability—for example, if you hire international employees or have a lot of turnover. It is also great for small businesses without in-house payroll or HR departments.

Manage payroll and access tools and services in one place

Those that are user friendly will usually provide hands-on training, digital learning tools, dedicated account resources or in-product demos to ensure that their clients can run payroll as proficiently as possible. To make things even easier, payroll software may also be capable of integrating with timekeeping, insurance and retirement solutions, and other HR programs. Organizations of all sizes use payroll software, but what works for one may not be suitable for another.

We calculate, pay, and file your taxes with the appropriate agencies – saving you time and reducing your risk of costly errors. They include calculating income tax withholding (federal, state, and local), depositing payroll taxes, and filing various returns to report payroll activities. A payroll management system can help you stay on top of payroll tax responsibilities, including calculating, paying, and filing assistance.

Detailed analytics are also offered in color-coded pie and bar charts for a straightforward interpretation of data. When I clicked on an element of the pie chart, a screen popped up to show more granular data regarding the broader how to convert accrual basis to cash basis accounting data point represented in the graph. To conduct my test-drive of OnPay’s platform, I used the Google Chrome browser on a Windows laptop and an Android mobile device.

This Post Has 0 Comments